So you want to get into algorithmic forex trading? I get it. The idea of having a computer program make money for you while you sleep is pretty appealing. I started down this path about four years ago after getting tired of staring at charts all day and making emotional trading decisions that usually ended up costing me money.

But here's the thing - algorithmic trading isn't some magic money-making machine that you can just set up and forget about. I learned this the hard way when my first "foolproof" algorithm lost about 30% of my account in two weeks. Turns out, programming a computer to trade forex is way more complex than I initially thought, and there are a ton of pitfalls that can trip you up if you're not careful.

What Actually Is Algorithmic Forex Trading?

Let's start with the basics. Algorithmic trading (or algo trading) is essentially using computer programs to automatically execute trades based on predefined rules and conditions. Instead of manually placing trades, your algorithm watches the market 24/7 and makes trading decisions based on the logic you've programmed into it.

The cool thing about forex markets is that they're open almost constantly during weekdays, which makes them perfect for algorithmic trading. While you're sleeping, your algorithm can be monitoring price movements, analyzing technical indicators, and executing trades based on your strategy.

But don't think this means you can just copy some code from the internet and start making money. Successful algorithmic trading requires a solid understanding of both programming and trading concepts. You need to know how markets behave, what strategies actually work, and how to translate those strategies into code that can execute reliably.

Getting Started: Choosing Your Tools and Platform

The first decision you'll need to make is what programming language and trading platform to use. There are several popular options, each with their own pros and cons.

MetaTrader 4 and 5 are probably the most beginner-friendly options. They use MQL4 and MQL5 respectively, which are specialized languages designed specifically for trading algorithms (called Expert Advisors or EAs). The syntax is similar to C++, but with built-in functions for accessing market data and placing trades.

Python is another popular choice, especially if you're coming from a programming background. It has excellent libraries for data analysis and machine learning, plus you can connect to most forex brokers through APIs. Here's a simple example of what a basic trading signal might look like in Python:

import pandas as pd

import numpy as np

def simple_moving_average_strategy(prices, short_window=20, long_window=50):

"""

Basic moving average crossover strategy

Buy when short MA crosses above long MA

Sell when short MA crosses below long MA

"""

signals = pd.DataFrame(index=prices.index)

signals['price'] = prices

# Calculate moving averages

signals['short_ma'] = prices.rolling(window=short_window).mean()

signals['long_ma'] = prices.rolling(window=long_window).mean()

# Generate signals

signals['signal'] = 0.0

signals['signal'][short_window:] = np.where(

signals['short_ma'][short_window:] > signals['long_ma'][short_window:], 1.0, 0.0

)

# Generate trading orders

signals['positions'] = signals['signal'].diff()

return signals

This is a super basic example, but it shows how you can translate a trading concept (moving average crossover) into code. In real trading, you'd need to add risk management, position sizing, and connection to your broker's API.

Building Your First Trading Algorithm

When I was building my first algorithm, I made the mistake of trying to create something overly complex right from the start. I wanted to incorporate every technical indicator I'd ever heard of and create some kind of super-sophisticated system. It was a disaster.

My advice? Start simple. Really simple. Pick one strategy that you understand well from manual trading and try to code that first. Maybe it's a simple RSI oversold/overbought strategy, or a basic support and resistance breakout system. The goal isn't to create the most profitable strategy ever - it's to learn how to translate trading logic into working code.

Here are the core components every forex trading algorithm needs:

- Market data feed - real-time or historical price data for backtesting

- Signal generation - the logic that determines when to buy or sell

- Risk management - position sizing, stop losses, take profits

- Order execution - actually placing trades with your broker

- Performance tracking - monitoring wins, losses, and overall performance

The signal generation part is usually what people focus on, but honestly, the risk management component is way more important for long-term success. I've seen algorithms with mediocre win rates make consistent profits because they managed risk well, and I've seen algorithms with high win rates blow up accounts because they didn't protect against large losses.

Backtesting: Testing Your Strategy Against History

Before you even think about running your algorithm with real money, you need to backtest it against historical data. Backtesting shows you how your strategy would have performed in the past, which gives you some idea of whether it might work in the future.

But here's where a lot of people mess up - they backtest their strategy and see great results, then assume those results will continue in live trading. Backtesting is useful, but it's not a guarantee of future performance. Markets change, and strategies that worked in the past might not work going forward.

The biggest mistake I made with my first algorithm was over-optimizing based on backtest results. I kept tweaking parameters until the backtest looked perfect, but then it failed miserably in live trading because I'd basically curve-fitted it to historical data.

Painful lesson learned in 2021

When backtesting, make sure you're using quality data and accounting for realistic trading costs. Don't just test on the major currency pairs during normal market hours - see how your strategy performs during volatile periods, thin markets, and major news events. Those edge cases are often where algorithms break down.

Also, be realistic about execution. Your backtest might show you buying at the exact low of a candle, but in real trading, you'll face slippage, spreads, and latency. Build these costs into your backtesting model so you get a more realistic picture of expected performance.

Risk Management: The Make-or-Break Component

I can't stress this enough - risk management will determine whether your algorithm makes money or loses money over the long term. You can have the best signal generation logic in the world, but if you don't manage risk properly, you'll eventually blow up your account.

Position sizing is crucial. Never risk more than 1-2% of your account on any single trade, even if your algorithm is showing a high-probability setup. I learned this lesson when my algorithm identified what looked like a "sure thing" trade and I let it risk 10% of my account. Of course, it was wrong, and I lost a big chunk of my capital on a single trade.

Here's a simple position sizing function that I use in my algorithms:

def calculate_position_size(account_balance, risk_percent, entry_price, stop_loss):

"""

Calculate position size based on account risk

"""

risk_amount = account_balance * (risk_percent / 100)

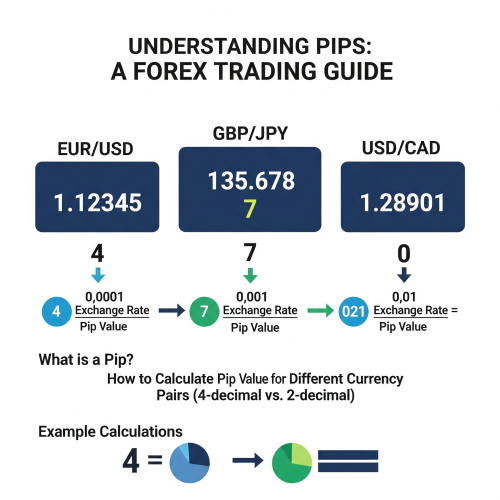

pip_risk = abs(entry_price - stop_loss) * 10000 # assuming 4-decimal currency pair

pip_value = 10 # for standard lot in USD account

position_size = risk_amount / (pip_risk * pip_value)

# Round down to avoid over-risking

return math.floor(position_size * 100) / 100

Stop losses are non-negotiable. Every trade your algorithm makes should have a predetermined exit point if things go wrong. Don't let your algorithm hold losing positions hoping they'll come back - that's a recipe for disaster.

Dealing with Market Conditions and Adaptability

One thing that really surprised me when I started algorithmic trading was how much market conditions can change. A strategy that works great during trending markets might completely fail during ranging markets. Similarly, strategies that work during normal volatility might break down during major news events or market stress.

The best algorithms I've seen have some ability to adapt to changing market conditions. This might mean using different strategies for different market regimes, or adjusting position sizes based on current volatility levels.

You can build simple market regime filters into your algorithms. For example, you might measure the average true range (ATR) over the past 20 periods and only trade your breakout strategy when volatility is above a certain threshold. Or you might use a trend strength indicator to determine whether to use a trend-following or mean-reversion approach.

Common Pitfalls and How to Avoid Them

After four years of doing this and plenty of expensive mistakes, here are the biggest pitfalls I see people fall into:

Over-optimization is probably the biggest one. It's tempting to keep tweaking your algorithm's parameters until the backtest results look amazing, but this usually leads to strategies that are too specific to historical data and don't work in live markets.

Ignoring transaction costs is another big mistake. Spreads, commissions, and slippage can eat into your profits significantly, especially if your algorithm trades frequently. Make sure you're accounting for all trading costs in your backtesting and live trading.

- Not testing during different market conditions - your algorithm should work in trending, ranging, and volatile markets

- Using too much leverage - just because your broker offers 100:1 leverage doesn't mean you should use it

- Not monitoring performance - algorithms can break or stop working, so you need to keep an eye on them

- Expecting consistent returns - even good algorithms will have losing periods

I also see a lot of people trying to create algorithms that trade too frequently. High-frequency strategies might look profitable in backtests, but in reality, transaction costs and execution challenges often make them unprofitable for retail traders.

Tools and Resources for Algorithm Development

If you're serious about getting into algorithmic trading, you'll need some good tools and resources. For data analysis and backtesting, I recommend learning Python with libraries like pandas, numpy, and matplotlib. These are industry-standard tools that will serve you well.

For live trading, you'll need a broker that offers API access. Interactive Brokers, OANDA, and Alpaca are popular choices that offer robust APIs and good documentation. Make sure your broker supports the programming language you want to use.

For learning, I'd recommend starting with some online courses on algorithmic trading. Quantitative Finance courses on platforms like Coursera or edX can give you a good foundation in the mathematical concepts behind trading strategies.

Don't try to reinvent the wheel when you're starting out. There are plenty of open-source libraries and frameworks that can handle the heavy lifting of connecting to brokers and managing trades. Focus your efforts on strategy development and risk management.

Advice I wish I'd followed from day one

Working With Your Broker: The API Connection

Here's something that caught me off guard when I first started - not all brokers are created equal when it comes to algorithmic trading. Some brokers actively encourage algo trading and provide robust APIs, while others barely tolerate it or make it unnecessarily difficult.

Your broker essentially acts as the bridge between your algorithm and the actual forex market. When your code decides to buy EUR/USD, it sends that order through your broker's API to their trading servers, which then execute the trade in the market. This might sound straightforward, but there are lots of ways this process can go wrong.

First, you need to make sure your broker actually supports algorithmic trading. Some brokers only allow manual trading through their platforms and don't offer API access at all. Others might offer APIs but with significant limitations - maybe they only allow a certain number of requests per minute, or they don't support all the order types your strategy needs.

When I was evaluating brokers for algorithmic trading, I had to consider several factors that don't matter as much for manual trading:

- API reliability and uptime - if the API goes down, your algorithm can't trade

- Execution speed and latency - crucial for strategies that rely on quick execution

- Order types supported - does the broker support stop orders, limit orders, OCO orders through the API?

- Rate limits - how many API calls can you make per second/minute?

- Historical data access - can you get the data you need for backtesting?

Here's a simple example of how you might connect to a broker's API using Python (this is pseudo-code, actual implementation varies by broker):

import requests

import json

class BrokerAPI:

def __init__(self, api_key, account_id):

self.api_key = api_key

self.account_id = account_id

self.base_url = "https://api.broker.com/v1"

def place_order(self, symbol, side, quantity, order_type="market"):

"""

Place a trading order through broker API

"""

headers = {

'Authorization': f'Bearer {self.api_key}',

'Content-Type': 'application/json'

}

order_data = {

'symbol': symbol,

'side': side, # 'buy' or 'sell'

'quantity': quantity,

'type': order_type,

'account_id': self.account_id

}

response = requests.post(

f"{self.base_url}/orders",

headers=headers,

data=json.dumps(order_data)

)

if response.status_code == 200:

return response.json()

else:

raise Exception(f"Order failed: {response.text}")

def get_account_balance(self):

"""

Get current account balance

"""

headers = {'Authorization': f'Bearer {self.api_key}'}

response = requests.get(

f"{self.base_url}/accounts/{self.account_id}/balance",

headers=headers

)

return response.json()['balance']

The quality of your broker's API can make a huge difference in your algorithm's performance. I once had an algorithm that looked great in backtesting, but when I ran it live, the broker's API was so slow that by the time my orders got executed, the prices had moved against me. What should have been profitable trades turned into consistent small losses due to execution delays.

Broker-Specific Considerations for Algo Trading

Different brokers handle algorithmic trading in different ways, and understanding these differences can save you a lot of headaches down the road.

MetaTrader Integration: If you're using MT4 or MT5, your algorithm (Expert Advisor) runs directly on the broker's platform. This means execution speeds are generally pretty good since everything happens locally. However, you're limited to the broker's implementation of MetaTrader, and some brokers modify the platform in ways that can affect EA performance.

REST APIs: Many modern brokers offer REST APIs that you can call from any programming language. This gives you more flexibility in terms of development tools, but introduces latency since your algorithm has to communicate over the internet with the broker's servers.

FIX Protocol: Some institutional brokers offer FIX (Financial Information eXchange) protocol access, which is faster and more reliable than REST APIs but also more complex to implement. This is usually overkill for retail algorithmic traders.

One thing that really surprised me was how different brokers handle things like partial fills and order rejections. With some brokers, if you place an order for 10,000 units and only 7,000 get filled, your algorithm needs to handle that partial fill appropriately. Other brokers might reject the entire order if they can't fill it completely.

I learned this lesson the hard way when my algorithm kept placing duplicate orders because the broker was partially filling my original orders, but I wasn't checking the fill status properly. Ended up with way larger positions than intended.

Expensive lesson from 2022

Managing Broker Relationships and Account Requirements

Most brokers that offer algorithmic trading capabilities have minimum account requirements that are higher than their regular trading accounts. This makes sense from their perspective - algo traders tend to trade more frequently and require more resources from the broker's infrastructure.

Some brokers also have specific requirements for algorithmic traders, like maintaining higher minimum balances or agreeing to additional terms of service. Make sure you understand these requirements before you start developing your algorithm around a particular broker's platform.

It's also worth having relationships with multiple brokers if possible. I keep small accounts with 2-3 different brokers that support algorithmic trading. This gives me backup options if one broker's API goes down, and it also lets me compare execution quality across different platforms.

Here are some questions you should ask potential brokers before committing to their platform:

- What's the maximum number of API calls I can make per minute?

- Do you support all the order types I need for my strategy?

- What happens if your API goes down during market hours?

- Are there any restrictions on algorithmic trading strategies?

- How do you handle slippage and requotes for API orders?

Going Live: From Backtesting to Real Money

Making the transition from backtesting to live trading is both exciting and terrifying. Even if your backtest results look great, there's always uncertainty about how your algorithm will perform with real money and real market conditions.

My recommendation is to start small - really small. Even if you plan to eventually trade with larger amounts, begin with the minimum position sizes your broker allows. This lets you see how your algorithm behaves in live markets without risking significant capital.

Monitor your algorithm closely during the first few weeks of live trading. Check that trades are being executed as expected, that risk management rules are being followed, and that performance is roughly in line with your backtest expectations. Pay special attention to how your broker is handling your orders - are you getting the prices you expect? How much slippage are you experiencing?

Be prepared for your algorithm to perform differently than your backtests suggested. This is normal and doesn't necessarily mean your strategy is flawed - it might just need some adjustments based on real market conditions and your broker's specific execution characteristics.

The Reality Check: Managing Expectations

Here's something I wish someone had told me when I was getting started: algorithmic trading is not a get-rich-quick scheme. Even successful algorithms typically generate modest returns with occasional drawdowns. If you're expecting to double your account every month, you're setting yourself up for disappointment and probably taking on way too much risk.

Good algorithmic trading strategies might generate 10-30% annual returns with manageable risk. That's still pretty good compared to traditional investments, but it's not the 500% returns that some people imagine when they think about algorithmic trading.

Also, don't expect your algorithm to work forever without maintenance. Markets change, and strategies that work today might stop working tomorrow. You'll need to continuously monitor performance, update your algorithms, and potentially develop new strategies over time.

The most successful algorithmic traders I know treat it like a business, not a hobby. They spend time researching new strategies, analyzing their performance data, and continuously improving their systems. If you're not prepared to put in that kind of ongoing effort, algorithmic trading might not be for you.

That said, if you do have the patience to learn properly and the discipline to manage risk carefully, algorithmic forex trading can be a rewarding way to participate in the markets. Just remember that success comes from proper preparation, realistic expectations, and lots of patience along the way.

0 Comment