Picture this: You're sitting at your computer at 3 AM, watching those little green and red candles dance across your screen like some kind of financial disco. Your heart's racing because you just realized you have no idea what a "pip" actually is, and you definitely don't know if you should be buying or selling right now. Sound familiar? Don't worry – we've all been there, staring at our screens like deer in headlights, wondering if we're about to make money or accidentally buy a small country.

Here's the thing about Forex trading: it's not rocket science, but it's not exactly finger painting either. It sits somewhere in that sweet spot where a little knowledge goes a long way, and the right approach can turn those confusing charts into your personal money-printing machine. Well, maybe not quite that simple, but you get the idea!

What Exactly Is A Pip And Why Should You Care?

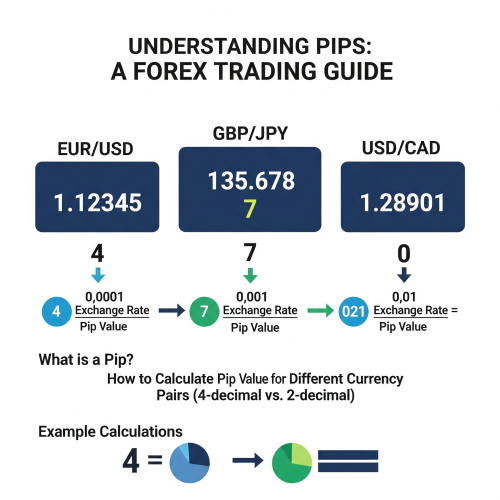

Let's start with the basics because, honestly, if you don't understand pips, you're basically trying to bake a cake without knowing what flour is. A pip (which stands for "percentage in point" or "price interest point" – traders love their acronyms) is the smallest price movement in a currency pair.

For most currency pairs, a pip is the fourth decimal place. So if EUR/USD moves from 1.1050 to 1.1051, that's a one-pip movement. Think of it as the heartbeat of the Forex market – tiny movements that add up to big changes over time.

Calculating Pip Value: The Math That Actually Matters

Now, here's where it gets interesting. The value of each pip depends on three things: the currency pair you're trading, your position size (lot size), and your account currency. I know, I know – math wasn't your favorite subject in school, but stick with me here.

// Pip Value Calculator Function

function calculatePipValue(currencyPair, lotSize, accountCurrency, exchangeRate) {

let pipValue;

// For pairs where USD is the quote currency (like EUR/USD)

if (currencyPair.includes('USD') && currencyPair.indexOf('USD') === 3) {

pipValue = (0.0001 * lotSize * 100000) / 1;

}

// For pairs where USD is the base currency (like USD/JPY)

else if (currencyPair.includes('USD') && currencyPair.indexOf('USD') === 0) {

// JPY pairs use 0.01 instead of 0.0001

let pipIncrement = currencyPair.includes('JPY') ? 0.01 : 0.0001;

pipValue = (pipIncrement * lotSize * 100000) / exchangeRate;

}

// For cross currency pairs

else {

pipValue = (0.0001 * lotSize * 100000 * exchangeRate);

}

return pipValue;

}

// Example usage

let eurUsdPipValue = calculatePipValue('EURUSD', 1, 'USD', 1.1050);

console.log(`One pip in EUR/USD (1 standard lot) = $${eurUsdPipValue}`);

// Risk calculation

function calculateRisk(pipValue, stopLossPips) {

return pipValue * stopLossPips;

}

let riskAmount = calculateRisk(10, 50); // $10 per pip, 50 pip stop loss

console.log(`Total risk: $${riskAmount}`);

Lot Sizes: From Micro To Standard (And Everything In Between)

Think of lot sizes as the "serving sizes" of Forex trading. You wouldn't order a gallon of ice cream for dessert (well, maybe you would, but that's between you and your freezer), and similarly, you need to choose the right position size for your account.

- Micro Lots (0.01): 1,000 units of base currency – perfect for beginners

- Mini Lots (0.1): 10,000 units – the middle ground for growing accounts

- Standard Lots (1.0): 100,000 units – for the big players with substantial capital

- Nano Lots (0.001): 100 units – some brokers offer these for ultra-small trading

Here's the golden rule: never risk more than 1-2% of your account on a single trade. If you have a $1,000 account, your maximum risk per trade should be $10-20. This isn't being conservative; it's being smart. The market will always be there tomorrow, but your account might not be if you get too aggressive.

Technical Analysis: Reading The Market's Mood Swings

Technical analysis is basically the art of reading the market's diary. Those charts aren't just pretty pictures – they're telling you stories about what traders are thinking, feeling, and most importantly, doing with their money.

The key indicators you should get cozy with include moving averages (they smooth out price action like a good moisturizer), RSI (tells you when a currency is overbought or oversold), and MACD (great for spotting trend changes). But remember, indicators are like GPS navigation – useful tools, but they can't drive the car for you.

The market can remain irrational longer than you can remain solvent. Technical analysis helps you identify probabilities, not certainties. Always combine multiple indicators and never rely on just one signal.

Trading Wisdom

Fundamental Analysis: When The News Moves Mountains

While technical analysis looks at what's happening on the charts, fundamental analysis asks why it's happening. Economic indicators, political events, and market sentiment all play starring roles in this drama we call Forex trading.

Key economic indicators to watch include GDP growth rates, inflation data, employment figures, and central bank decisions. When the Federal Reserve hints at raising interest rates, you better believe the USD is going to react. It's like watching a soap opera, except the plot twists can make or break your trading account.

Entry And Exit Strategies: Timing Is Everything

Here's where the rubber meets the road. You can have all the analysis in the world, but if your timing is off, you might as well be throwing darts at a board while blindfolded. The best entry and exit strategies combine both technical and fundamental analysis.

- Wait for confirmation signals before entering trades

- Set your stop loss before you enter the trade, not after you're losing money

- Use trailing stops to lock in profits as trades move in your favor

- Don't be greedy – take profits when you have them

- Learn to cut losses quickly and let winners run

Risk Management: Your Financial Safety Net

This is probably the most boring part of trading, which is exactly why most people ignore it and exactly why most people lose money. Risk management isn't about limiting your profits; it's about ensuring you live to trade another day.

// Risk Management Calculator

class RiskManager {

constructor(accountBalance, riskPercentage = 2) {

this.accountBalance = accountBalance;

this.riskPercentage = riskPercentage;

}

calculatePositionSize(entryPrice, stopLoss, pipValue) {

// Calculate risk amount

const riskAmount = (this.accountBalance * this.riskPercentage) / 100;

// Calculate stop loss in pips

const stopLossPips = Math.abs(entryPrice - stopLoss) * 10000; // for 4-decimal pairs

// Calculate position size

const positionSize = riskAmount / (stopLossPips * pipValue);

return {

riskAmount: riskAmount,

stopLossPips: stopLossPips,

positionSize: Math.round(positionSize * 100) / 100, // Round to 2 decimals

maxLoss: riskAmount

};

}

validateTrade(positionSize, accountBalance) {

const marginRequired = positionSize * 100000 * 0.01; // 1:100 leverage

const marginAvailable = accountBalance * 0.8; // 80% of account

return {

isValid: marginRequired <= marginAvailable,

marginRequired: marginRequired,

marginAvailable: marginAvailable

};

}

}

// Usage example

const riskManager = new RiskManager(5000, 2); // $5000 account, 2% risk

const trade = riskManager.calculatePositionSize(1.1050, 1.1000, 10);

console.log('Trade Analysis:', trade);

console.log('Validation:', riskManager.validateTrade(trade.positionSize, 5000));

The Psychology Game: Your Biggest Enemy (And Ally)

Here's a hard truth: the biggest obstacle to profitable trading isn't the market – it's the person staring back at you in the mirror. Fear, greed, hope, and despair can turn a perfectly good trading strategy into a disaster faster than you can say "margin call."

Successful traders develop emotional discipline through practice, meditation, and sometimes by literally writing down their trading rules and taping them to their monitor. Whatever works, right? The key is to trade your plan, not your emotions.

Remember, every professional trader has blown up an account at least once (and if they say they haven't, they're either lying or they started trading last week). The difference between professionals and amateurs isn't that pros never lose money – it's that they lose small amounts quickly and make larger amounts slowly.

The Forex market is a 24-hour-a-day beast that never sleeps, never takes a holiday, and certainly never feels sorry for your losses. But here's the beautiful thing: it's also completely impartial. It doesn't care about your background, your education, or how much money you started with. It only cares about one thing: can you consistently make good decisions under pressure?

So start small, learn constantly, and remember that profitable trading is a marathon, not a sprint. Master the basics of pip calculation, choose appropriate lot sizes for your account, use both technical and fundamental analysis to inform your decisions, and never, ever forget that risk management isn't optional – it's your lifeline in the wild world of Forex trading.

Kirbywhopy

В этой статье собраны факты, которые освещают целый ряд важных вопросов. Мы стремимся предложить читателям четкую, достоверную информацию, которая поможет сформировать собственное мнение и лучше понять сложные аспекты рассматриваемой темы. Подробнее тут - https://vivod-iz-zapoya-1.ru/

CharlesDiarl

Эта познавательная публикация погружает вас в море интересного контента, который быстро захватит ваше внимание. Мы рассмотрим важные аспекты темы и предоставим вам уникальныеInsights и полезные сведения для дальнейшего изучения. Детальнее - https://quick-vyvod-iz-zapoya-1.ru/