Picture this: you've just made your first forex trade, the charts are moving in your favor, and you're feeling pretty good about yourself. Then someone asks, "How many pips did you make?" and suddenly you're staring at them like they just asked you to solve quantum physics. Don't worry – we've all been there! Understanding pips is like learning to ride a bike in the forex world: once you get it, you'll wonder why it ever seemed complicated.

What Exactly Is A Pip Anyway?

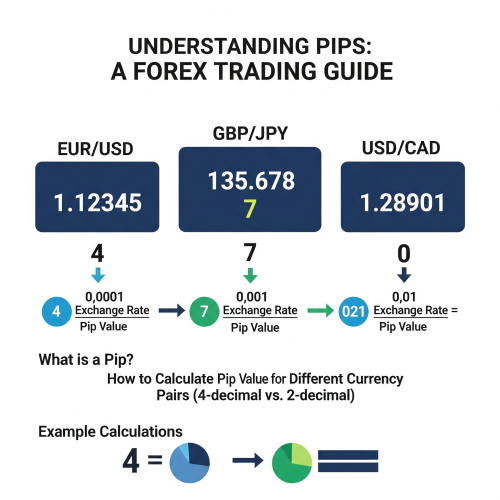

A pip (which stands for "Percentage in Point" or "Price Interest Point" – traders love their acronyms) is the smallest price movement in a currency pair. Think of it as the forex equivalent of cents in your pocket change. For most currency pairs, a pip is the fourth decimal place, so if EUR/USD moves from 1.1050 to 1.1051, that's a one-pip movement. Simple enough, right?

But here's where it gets slightly more interesting: Japanese yen pairs are the rebels of the forex world. For pairs like USD/JPY, a pip is the second decimal place because the yen trades at much smaller values. So if USD/JPY moves from 110.50 to 110.51, that's one pip. It's like the yen decided to be different just to keep us on our toes!

The Basic Pip Calculation Formula

Now, let's get into the meat and potatoes of pip calculation. The basic formula is surprisingly straightforward:

// Basic Pip Value Calculation

function calculatePipValue(currencyPair, lotSize, accountCurrency) {

let pipLocation;

let exchangeRate;

// Determine pip location based on currency pair

if (currencyPair.includes('JPY')) {

pipLocation = 0.01; // Second decimal place for JPY pairs

} else {

pipLocation = 0.0001; // Fourth decimal place for other pairs

}

// Standard lot size is 100,000 units

const standardLot = 100000;

const tradeSize = lotSize * standardLot;

// Calculate pip value

const pipValue = (pipLocation * tradeSize);

return pipValue;

}

// Example usage

const eurUsdPipValue = calculatePipValue('EUR/USD', 1, 'USD');

const usdJpyPipValue = calculatePipValue('USD/JPY', 1, 'USD');

console.log(`EUR/USD pip value: $${eurUsdPipValue}`);

console.log(`USD/JPY pip value: ¥${usdJpyPipValue}`);

Breaking Down Different Currency Pair Types

Not all currency pairs are created equal, and neither are their pip calculations. Let me break this down into digestible chunks:

- Direct Pairs (USD as quote currency): EUR/USD, GBP/USD, AUD/USD – These are the friendly neighbors of forex

- Indirect Pairs (USD as base currency): USD/CHF, USD/CAD, USD/JPY – A bit more complex but still manageable

- Cross Pairs (No USD involved): EUR/GBP, GBP/JPY, EUR/AUD – The wild cards that keep things interesting

Real-World Examples That Actually Make Sense

Let's say you're trading EUR/USD with a standard lot (100,000 units), and the pair moves from 1.1050 to 1.1070. That's a 20-pip movement. If each pip is worth $10 (which is standard for EUR/USD with a $1 lot size), you've just made $200. Not bad for a day's work!

But wait, there's more complexity when dealing with different account currencies. If your account is in British pounds but you're trading EUR/USD, you'll need to convert that pip value using the current GBP/USD exchange rate. It's like doing currency conversion at the airport, but with more zeros involved.

The key to successful forex trading isn't just knowing how to calculate pips – it's understanding how those pips translate into real money in your account. Every pip has a story, and every story affects your bottom line.

Professional Forex Trader

Advanced Pip Calculation Scenarios

Now let's tackle the scenarios that make your head spin. Cross currency pairs are where things get spicy. When you're trading EUR/GBP and your account is in USD, you're essentially dealing with three currencies at once. It's like trying to juggle while riding a unicycle – possible, but requires practice.

// Advanced pip calculation for cross pairs

function calculateCrossPairPipValue(baseCurrency, quoteCurrency, accountCurrency, lotSize, currentRates) {

const pipLocation = quoteCurrency === 'JPY' ? 0.01 : 0.0001;

const standardLot = 100000;

const tradeSize = lotSize * standardLot;

// Calculate base pip value

let pipValue = (pipLocation * tradeSize);

// Convert to account currency if needed

if (quoteCurrency !== accountCurrency) {

const conversionPair = `${quoteCurrency}/${accountCurrency}`;

const conversionRate = currentRates[conversionPair];

if (conversionRate) {

pipValue *= conversionRate;

} else {

// Try inverse pair

const inversePair = `${accountCurrency}/${quoteCurrency}`;

const inverseRate = currentRates[inversePair];

if (inverseRate) {

pipValue /= inverseRate;

}

}

}

return {

pipValue: pipValue.toFixed(2),

currency: accountCurrency,

calculation: `${pipLocation} × ${tradeSize} = ${pipValue} ${quoteCurrency}`

};

}

// Example with current market rates

const marketRates = {

'EUR/USD': 1.1050,

'GBP/USD': 1.2750,

'USD/JPY': 110.50

};

const result = calculateCrossPairPipValue('EUR', 'GBP', 'USD', 1, marketRates);

console.log(result);

Common Mistakes That'll Cost You Money

- Confusing pip location for JPY pairs – remember, it's the second decimal place, not the fourth

- Forgetting to account for your account currency when trading cross pairs

- Mixing up lot sizes – a mini lot is 10,000 units, not 1,000

- Not updating exchange rates for cross-currency calculations

- Assuming all brokers use the same pip value standards (some use fractional pips)

Fractional Pips: The Plot Thickens

Just when you thought you had it all figured out, the forex market throws you a curveball: fractional pips, also known as pipettes. These are the fifth decimal place for most pairs (third for JPY pairs). It's like splitting a penny into ten pieces – technically possible, but you need good eyes to see the difference.

Many modern brokers now quote prices with fractional pips, so EUR/USD might show as 1.10503 instead of 1.1050. That extra "3" is a fractional pip. While it might seem insignificant, when you're dealing with large position sizes, those fractions add up faster than compound interest on a credit card.

Practical Tips for Pip Calculation Success

Here's the reality check: most professional traders don't sit there calculating pips manually all day. We live in the age of trading platforms that do the heavy lifting for us. However, understanding the mechanics behind the calculations is crucial for several reasons.

First, it helps you verify that your trading platform is calculating everything correctly. Trust but verify, as they say. Second, it gives you a deeper understanding of how currency fluctuations affect your positions. And third, it makes you sound incredibly sophisticated at trader meetups.

The most important thing to remember is that pip calculation is just one piece of the trading puzzle. You also need to consider spreads, commission, swap rates, and that little thing called market volatility that can turn a calm Tuesday into a roller coaster ride.

Understanding pips is like learning to read music – once you know the language, you can appreciate the symphony of price movements and make informed decisions about when to dance and when to sit out.

Market Analysis Expert

Remember, the goal isn't to become a human calculator, but to understand the mechanics well enough that you can focus on what really matters: making profitable trading decisions. After all, you could calculate pips all day long, but if you're consistently picking the wrong direction, those calculations won't help your account balance.

So there you have it – pip calculation demystified, with just enough complexity to keep things interesting but not so much that you need a PhD in mathematics. Practice with small amounts, use the tools available to you, and remember that every expert was once a beginner who probably asked the same "how many pips did you make?" question that started this whole journey.

anarchiveofromanceEmive

I appreciate the anonymity of the internet. Accessing an archive of romance allows me to explore niche interests. I can download PDF books on topics I might be too shy to buy in a store, exploring my preferences in private. https://anarchiveofromancepdf.top/ An Archive Of Romance Pdf File

anarchiveofromanceEmive

I recently decided to switch to digital reading to save paper. Using an archive of romance is an eco-friendly way to enjoy my favorite hobby. The PDF files are high quality and offer a sustainable alternative to buying paperback throwaways that simply gather dust on the shelf. https://anarchiveofromancepdf.top/ An Archive Of Romance Ava Reid Pdf Download

youcanscreampdfEmive

Get the PDF that makes you scream with anticipation. You can read it on your lunch break or during a flight. It is the ultimate travel companion. Light, portable, and full of entertainment, it is everything a modern book should be. https://youcanscreampdf.top/ You Can Scream Fiction Book Pdf

myhusbandswifepdfEmive

Step into the shoes of characters living on the edge. This novel offers a glimpse into a chaotic marriage. The digital PDF is your ticket to this exciting world. Download it today and witness the unraveling of a husband's carefully constructed life. https://myhusbandswifepdf.top/ My Husband's Wife Hardcover Pdf

anatomyofanalibipdEmive

Find the Anatomy of an Alibi PDF here for a quick and easy download. This file offers the complete text of the novel. enjoy the crisp, clear formatting on any screen. Start your reading adventure today. https://anatomyofanalibipdf.top/ Anatomy Of An Alibi Digital Copy

alcotthallpdfEmive

The Alcott Hall PDF is a fantastic resource for digital archives. It offers a detailed history of the estate. Download the file today and enjoy a high-quality reading experience that brings the past to life. https://alcotthallpdf.top/ Alcott Hall Pdf Free

itshouldhavebeenyoEmive

Enjoy the comfortable reading experience of this digital edition. The PDF of It Should Have Been You is comfy. It should have been you relaxing with it. Get the download today and enjoy. https://itshouldhavebeenyoupdf.top/ It Should Have Been You Pdf

anarchiveofromanceEmive

I have been searching for a way to carry my favorite books with me while traveling. Finding a dedicated archive of romance novels in PDF format has solved my problem. Now I can access hundreds of emotional and passionate stories directly on my phone, making long commutes much more enjoyable. https://anarchiveofromancepdf.top/ An Archive Of Romance Text Pdf

youcanscreampdfEmive

If you want a story that makes you scream, you can trailer the PDF. It is a show. The download is movie. film and play. https://youcanscreampdf.top/ You Can Scream Rebecca Zanetti Free

itshouldhavebeenyoEmive

Experience the rush of a page-turner with the digital version. The PDF of It Should Have Been You is fast-paced. It should have been you racing to the end. Get the file now and enjoy. https://itshouldhavebeenyoupdf.top/ It Should Have Been You English Edition

alcotthallpdfEmive

Discover the hidden history behind the famous estate by accessing the Alcott Hall PDF today. This comprehensive document offers readers a unique glimpse into the architectural marvels and social stories of the past. Download your digital copy now to enjoy a seamless reading experience on any device you choose. https://alcotthallpdf.top/ Alcott Hall Pdf No Sign Up

anarchiveofromanceEmive

For those who love to write reviews, access to books is key. An archive of romance provides plenty of material. I download PDF copies to review on my social media, helping other readers find their next great read among the vast selection available. https://anarchiveofromancepdf.top/ An Archive Of Romance Pdf

anarchiveofromanceEmive

I enjoy the simplicity of a text-based interface. A minimalist archive of romance focuses on the books, not the graphics. I can quickly find the text I want and download the PDF without being distracted by unnecessary ads or slow-loading images. https://anarchiveofromancepdf.top/ An Archive Of Romance Fiction Pdf

inyourdreamspdfEmive

The In Your Dreams PDF is essential reading. Its digital format makes it accessible to everyone, ensuring that this great story can be shared and enjoyed by all. https://inyourdreamspdf.top/ In Your Dreams Pdf Online

sunriseonthereapinEmive

Download Sunrise on the Reaping PDF free today. Suzanne Collins returns with this fifth Hunger Games novel revealing Haymitch Abernathy's tragic transformation before the rebellion. Witness the fiftieth Games brutality. Instant access without any registration or payment requirements for this emotional masterpiece. https://sunriseonthereapingpdf.top/ Sunrise On The Reaping Casting

ironflamepdfEmive

Unchain Iron Flame's story! Dragons, drama, devotion define Violet's arc. Get free PDF at ironflamepdf.top today! https://ironflamepdf.top/ Bonus Chapters Iron Flame Pdf Free Download

lightsoutpdfEmive

We have curated the best version of the Lights Out PDF for our visitors. Our focus on quality ensures you get a legible, professional document. It is the standard for digital downloads that other sites try to emulate. https://lightsoutpdf.top/ Lights Out Audiobook

ComoMandarPDFEmive

Si quieres aprender a negociar mejor, empieza por saber decir no, descarga el recurso y aprende a mandar a la media las ofertas bajas de forma educada, consiguiendo siempre lo que mereces por tu trabajo. https://comomandaralamediadeformaeducadapdf.cyou/ Como Mandar A La Mierda De Una Forma Educada

acourtofmistandfurEmive

Feyre is no longer just a human girl; she is something more. Witness her power in the A Court of Mist and Fury PDF. This digital download offers crystal clear text for an optimal reading experience. Don't wait to see how the story unfolds in the Night Court. https://acourtofmistandfurypdf.top/ A Court Of Mist And Fury Pdf Free

fourthwingpdfEmive

From the first trial to the final battle, the excitement never fades. The Fourth Wing PDF is the perfect format for devouring this action-packed story. Join the adventure today and see why readers are clamoring for the sequel. https://fourthwingpdf.top/ How Many Chapters In Fourth Wing

Kirbywhopy

Эта публикация завернет вас в вихрь увлекательного контента, сбрасывая стереотипы и открывая двери к новым идеям. Каждый абзац станет для вас открытием, полным ярких примеров и впечатляющих достижений. Подготовьтесь быть вовлеченными и удивленными каждый раз, когда продолжите читать. Получить дополнительную информацию - https://vivod-iz-zapoya-1.ru/

JamesROOFF

В этой статье вы найдете познавательную и занимательную информацию, которая поможет вам лучше понять мир вокруг. Мы собрали интересные данные, которые вдохновляют на размышления и побуждают к действиям. Открывайте новую информацию и получайте удовольствие от чтения! Изучить вопрос глубже - https://quick-vyvod-iz-zapoya-1.ru/

CharlesDiarl

Эта статья полна интересного контента, который побудит вас исследовать новые горизонты. Мы собрали полезные факты и удивительные истории, которые обогащают ваше понимание темы. Читайте, погружайтесь в детали и наслаждайтесь процессом изучения! Изучить вопрос глубже - https://quick-vyvod-iz-zapoya-1.ru/