Finding the right forex broker in 2025 feels like trying to pick the best pizza place in New York City - there are way too many options and everyone's got strong opinions about which one's actually worth your time and money. I've been trading forex for over six years now, and I've probably opened accounts with at least a dozen different brokers along the way. Some were great, some were absolute disasters, and a few taught me expensive lessons about why cheap isn't always better.

The forex brokerage landscape has changed quite a bit recently. We've seen some major players exit certain markets, new regulations shake things up, and technology improvements that have made trading more accessible than ever. But with all these changes, picking the right broker has somehow become both easier and harder at the same time.

What Makes a Forex Broker Actually Good in 2025?

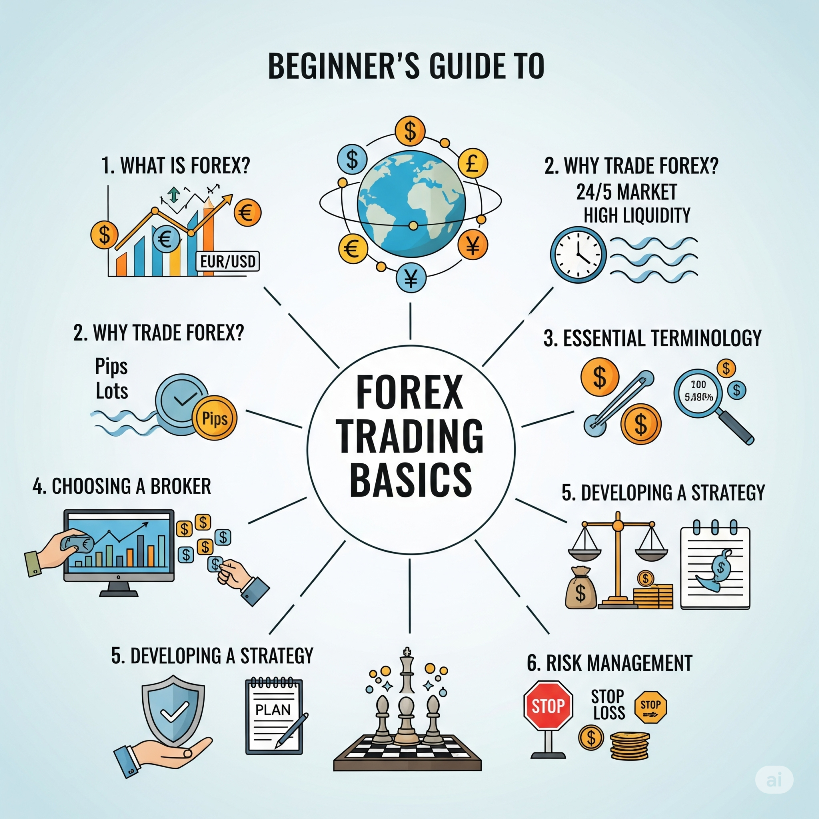

Before we dive into specific brokers, let's talk about what you should actually care about when choosing one. It's not just about who has the flashiest website or the most aggressive marketing campaigns.

Regulation is still king. I don't care how good their spreads look or how many fancy tools they offer - if they're not properly regulated, run the other way. In 2025, we're seeing stricter oversight than ever before, which is actually good news for retail traders. Look for brokers regulated by the FCA (UK), CFTC/NFA (US), ASIC (Australia), or CySEC (Cyprus) at minimum.

- Tight spreads and transparent pricing structure - no hidden fees that eat into your profits

- Fast execution speeds with minimal slippage during volatile market conditions

- Reliable platform that doesn't crash when you need it most

- Decent customer support that actually knows what they're talking about

- Good selection of currency pairs including the majors, minors, and some exotics

The Heavy Hitters: Top-Tier Brokers That Actually Deliver

Let me start with the brokers that I'd trust with my own money (and actually do). These aren't necessarily the cheapest options, but they're the ones that won't disappear with your funds or give you gray hairs when you're trying to close a position during market volatility.

IG Group has been around forever and they're still one of the most solid choices out there. Their spreads aren't the tightest you'll find, but their execution is rock-solid and their platform rarely gives me issues. I've been using them on and off for about three years now, and while their fees can be a bit higher than some competitors, you're paying for reliability. Their mobile app is also pretty decent, which matters more than you'd think when you're stuck in traffic and need to check your positions.

OANDA is another old-school broker that's adapted well to the modern trading environment. What I really like about them is their transparency around pricing - they show you exactly how they make their money instead of hiding fees in weird places. Their spreads are competitive, especially on major pairs, and they offer fractional pip pricing which can add up to real savings over time.

The best broker isn't the one with the lowest spreads or the highest leverage. It's the one that's still going to be there when the market gets crazy and you need to actually execute your trades.

Hard-learned wisdom from the 2020 market volatility

Interactive Brokers is kind of the trader's trader choice. Their platform looks like it was designed by engineers for engineers (because it probably was), but once you get used to it, it's incredibly powerful. Their spreads are among the best you'll find, and they offer access to pretty much every market you can think of. The downside? Their platform has a steep learning curve and their customer service can be hit or miss.

The Rising Stars: Newer Brokers Making Waves

The forex brokerage space has seen some interesting new players emerge in recent years. These brokers might not have decades of history behind them, but they're bringing fresh approaches to trading that are worth considering.

Pepperstone has really impressed me lately with their focus on execution speed. They're marketing themselves to scalpers and high-frequency traders, and from what I've seen, they can actually back up their claims. Their spreads are tight, especially during London and New York sessions, and their platform integration with MT4/MT5 is seamless.

XM Global might not be available everywhere due to regulatory restrictions, but where they do operate, they've built a solid reputation. Their educational resources are actually useful (unlike the generic garbage most brokers put out), and they offer some interesting account types for different trading styles.

Red Flags: Brokers to Approach with Caution

Not gonna name names here, but there are definitely some warning signs you should watch out for when evaluating brokers. I've learned some of these lessons the hard way, and trust me, you don't want to go through the stress of trying to get your money back from a sketchy broker.

If a broker is promising guaranteed profits or claims their system "never loses," that's an immediate red flag. Forex trading involves risk, period. Any broker that claims otherwise is either lying or doesn't understand the market they're facilitating trades in.

Be wary of brokers that make withdrawal difficult. A legitimate broker should process withdrawals quickly and without unnecessary hoops to jump through. If you're seeing lots of complaints online about people having trouble getting their money out, that's a massive red flag.

- Unrealistic bonus offers that seem too good to be true (they usually are)

- Lack of proper regulation or vague regulatory information

- Pressure tactics to deposit larger amounts or upgrade to "premium" accounts

- Spreads that widen dramatically during news events or market volatility

- Poor customer reviews that mention execution problems or withdrawal issues

Regional Considerations: Where You Live Matters

Here's something that a lot of broker comparison sites don't really emphasize enough - your location can dramatically impact which brokers are actually available to you and how they'll treat your account.

If you're in the US, your options are pretty limited due to strict CFTC regulations. You're basically looking at OANDA, Interactive Brokers, and a handful of others. The leverage is capped at 50:1 for major pairs, which honestly isn't a bad thing for most traders, but it's something to be aware of.

European traders have more options but also have to deal with ESMA regulations that limit leverage to 30:1 for retail accounts. Some brokers offer "professional" account status that gets around these limitations, but you need to meet certain criteria.

For traders in other regions, you generally have more flexibility in terms of broker choice and leverage options, but you also need to be more careful about regulation and oversight.

Don't just pick a broker because they accept clients from your country. Make sure they're actually regulated in a jurisdiction that will protect you if something goes wrong.

Advice I wish someone had given me in 2019

Platform Wars: MT4, MT5, or Proprietary?

The trading platform debate is almost as contentious as the broker debate itself. MetaTrader 4 is still the most popular platform among retail forex traders, and for good reason - it's stable, has tons of indicators and expert advisors available, and most people are familiar with it.

MT5 is technically superior to MT4 with more timeframes, better backtesting capabilities, and an improved programming language. But adoption has been slower than MetaQuotes probably hoped, partly because MT4 does everything most traders need it to do.

Some brokers offer proprietary platforms that can be really impressive. IG's platform, for example, has some features that you won't find in MT4/MT5. But there's always the risk of being locked into one broker if you get too comfortable with their specific platform.

My recommendation? Start with MT4 or MT5 since you can easily move between brokers without having to relearn everything. Once you're more experienced, you can explore proprietary platforms if they offer features you actually need.

The Cost Breakdown: What You're Actually Paying

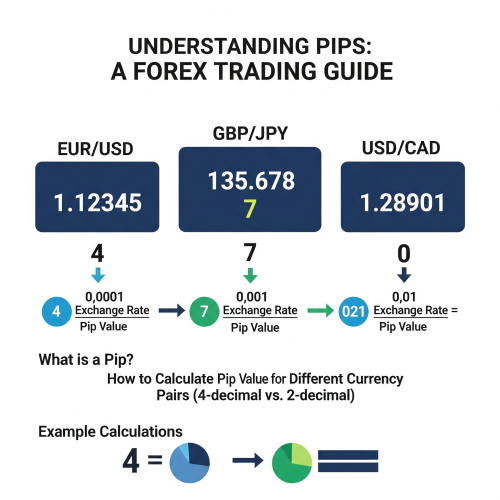

Broker pricing has gotten more complex over the years, and it's not always easy to figure out what you're actually going to pay in total trading costs. Most brokers make their money through spreads, but some also charge commissions, overnight financing fees, and various other charges that can add up.

Spread-only brokers like OANDA are straightforward - you pay the spread and that's it. Commission-based brokers like Interactive Brokers charge you a small commission per trade but often offer tighter spreads. For high-volume traders, commission-based pricing usually works out cheaper, but for casual traders, spread-only might be simpler.

Don't forget about overnight financing costs (swap rates). If you hold positions overnight, you'll either pay or receive interest depending on the currency pair and direction of your trade. These costs can add up significantly for longer-term positions.

Customer Service: When Things Go Wrong

You probably won't think much about customer service when you're choosing a broker, but trust me, when you need help, you really need help. I've had situations where trades weren't executing properly during volatile market conditions, and having access to knowledgeable support made the difference between a minor inconvenience and a major loss.

Test the customer service before you commit to a broker. Send them a technical question via chat or email and see how quickly and accurately they respond. If they can't answer basic questions about spreads or platform features, how are they going to help you when something actually important goes wrong?

Look for brokers that offer 24/5 support (since forex markets are open around the clock during weekdays) and multiple contact methods. Phone support is becoming less common but can be invaluable during urgent situations.

Making Your Final Decision

After all this analysis, how do you actually pick a broker? Here's my process: Start by narrowing down to brokers that are properly regulated in your jurisdiction and have good reputations. Then open demo accounts with your top 2-3 choices and actually trade with them for a few weeks.

Pay attention to execution speed, how the platform feels during your typical trading hours, and whether the spreads match what they advertise. Don't just look at the spreads during quiet market hours - check them during London open, New York open, and major news releases.

Once you've found a broker you're comfortable with on demo, start with a small live account. Even if you plan to trade with larger amounts eventually, begin small while you get used to their execution and any quirks their platform might have.

Final Thoughts: It's Not Just About the Broker

Here's something that took me way too long to realize - while choosing the right broker is important, it's not going to make or break your trading success. I've seen traders lose money with the best brokers and make money with mediocre ones. Your strategy, risk management, and discipline matter way more than whether you're getting 0.8 or 1.2 pip spreads on EUR/USD.

That said, don't use this as an excuse to be lazy about broker selection. A good broker won't guarantee your success, but a bad broker can definitely contribute to your failure. Do your research, test thoroughly, and choose a broker that supports your trading style and goals.

The forex brokerage landscape is going to keep evolving in 2025 and beyond. We'll probably see more consolidation, stricter regulations in some regions, and new technology that changes how we trade. But the fundamental principles of choosing a good broker - regulation, transparency, reliable execution, and fair pricing - those aren't going to change.

Whatever broker you end up choosing, remember that this isn't a lifetime commitment. As your trading evolves and your needs change, don't be afraid to switch brokers if your current one is no longer the best fit. Just make sure you understand any potential costs or complications before making the move.

Good luck finding the right broker for your trading journey. Take your time, do your homework, and don't let flashy marketing campaigns distract you from what really matters - finding a reliable partner for your forex trading adventures.

0 Comment